STRATEGY

Pouschine Cook is a private equity firm dedicated to optimizing the value of our investments in founder- and family-owned businesses, as well as in corporate divestitures.

Core Competencies

Our track record of over 20 years of working together and successfully transitioning companies to higher levels of growth and profitability rests on three core competencies:

Insight. A keen strategic sense enables us to see a company’s future competitive advantage and market potential, generate and review options, and formulate go-forward plans to increase value.

Flexibility. Our financial expertise enables us to structure each investment effectively and fairly, providing a solid framework for robust returns whether purchasing a strategic non-control or control equity position.

Enhancement. The combination of a partnership mentality, a “roll-up-your-sleeves” work ethic, and on-the-ground experience of our professionals and network of outside resources, enables us to guide and support operational execution to ensure ongoing value creation.

The Pouschine Cook Value Proposition

Our goal of driving up shareholder value begins with the intensive, analysis of every potential investment. For us, due diligence is a 360-degree undertaking that encompasses strategic assessment of strengths and vulnerabilities, financial analysis, evaluation of quality and style of management, and an examination of company culture.

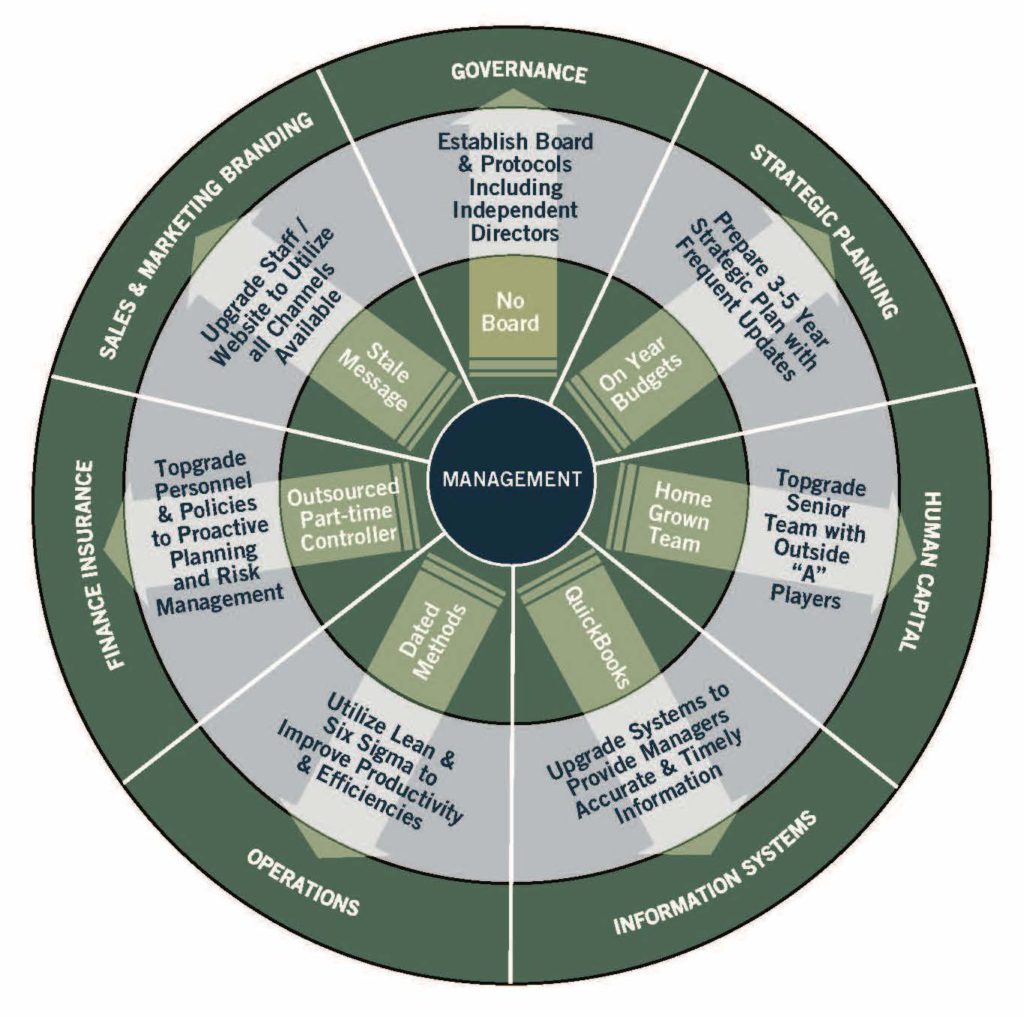

From this initial assessment, we work with management to develop an Enhancement Plan and then look for ways in which we can uniquely contribute value and evolve that plan. Through strategic advice and direct involvement, we help out companies in several areas, including:

- Establishing a strong board of directors and governance policies and procedures

- Developing strategic direction

- Management-team building

- Operating improvements

- Identifying, evaluating, structuring, financing, and integrating acquisitions

- Brand definition, strengthening, and marketing

- Upgrading business processes and information systems

- New market opportunities, products, and services

- Financing to support growth

- Refinancing and recapitalization opportunities

- Divestitures

- Exit strategies to maximize returns for all shareholder

Whenever additional support is required to carry out the implementation plan, Pouschine Cook reaches out to its network of expert advisers to assist.